In business and finance, two crucial terms often come to mind when assessing a company’s financial performance and pricing strategies: profit margin and profit markup. These terms, though related, provide distinct insights into a company’s profitability and pricing decisions.

Profit margin and profit markup serve as essential tools for businesses aiming to strike a balance between revenue generation and cost management. So, what exactly is a profit margin and profit markup? What’s their difference? And how do they shape your business’ financial outlook?

In this article, you will discover the distinction between profit margin and markup and the vital roles of each term in your business’ economy. Without further ado, let’s talk about what markup and margin is.

What is Profit Margin

Profit margin is a financial metric that corresponds to the profitability of a product by expressing the profit as a percentage of the total revenue or profit rendered.

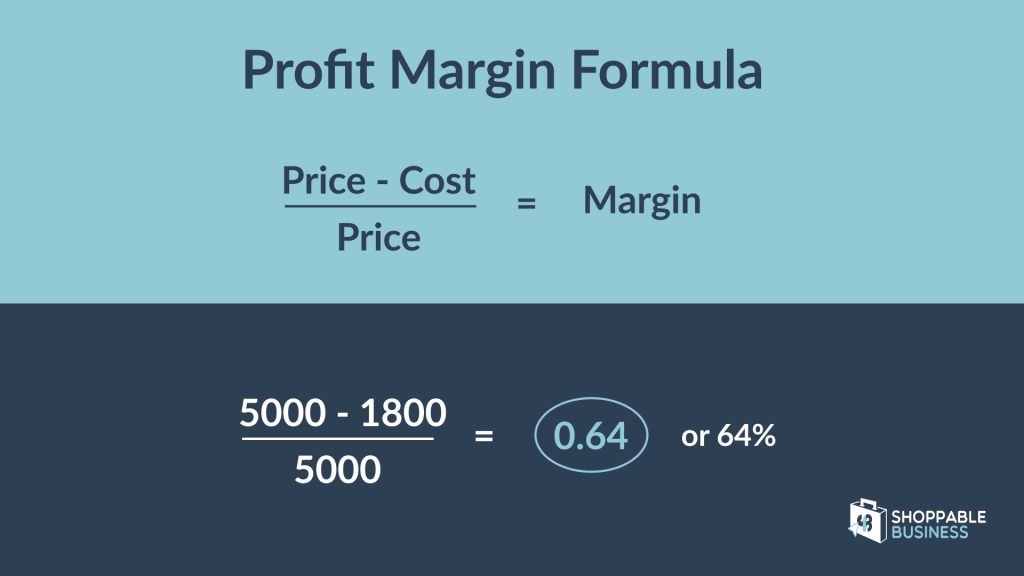

Formula for Profit Margin

Profit Margin Percentage = Price – Cost / Price = Margin

For example, the profit margin of the product you’re selling is at P5,000 per unit, with a cost of P1,800 to make, this gives you P3,200 of profit, which equates to 64% profit margin.

(5000 – 1800) / 5000 = 0.64 or 64%

The resulting profit margin percentage provides data into how much profit a company is able to generate for each cost of revenue it earns. A higher profit margin percentage indicates that a company is more efficient at controlling its costs and generating profits, which is generally viewed as a positive sign of profitability.

What is Profit Markup

On the other hand, profit markup is what you add to the cost of the product, in order to produce a profit. It is a pricing strategy used by businesses to determine the selling price of a product or service. It represents the amount or percentage added to the cost of producing or acquiring a product to establish its selling price, allowing the business to generate a profit.

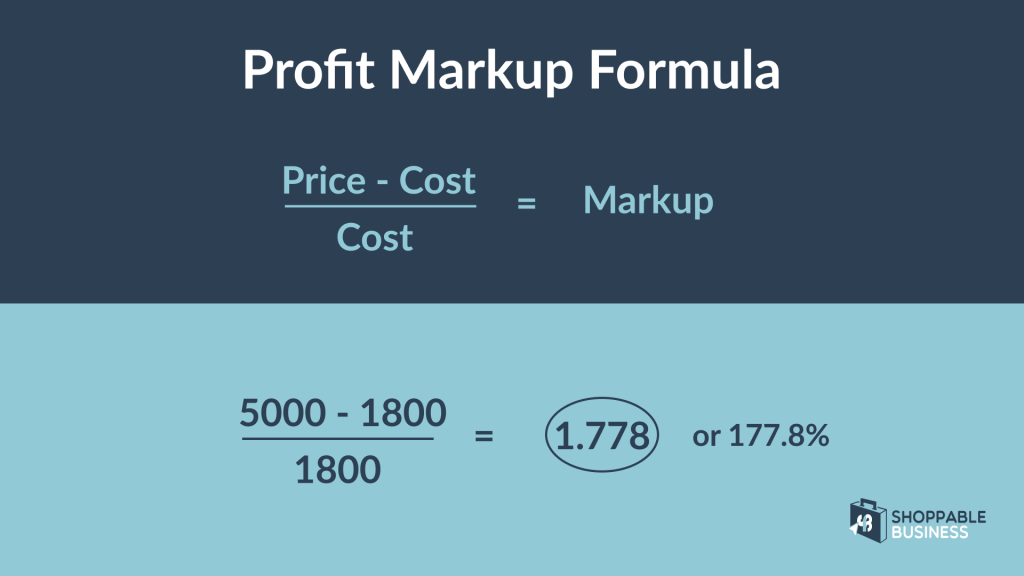

Formula for Profit Markup

The formula for calculating profit markup is straightforward:

Markup Profit = Price – Cost / Cost = Markup

Using the example above, a mark up of P3,200 on a product that costs P1,800 to make would give you a product that sells at P5,000. Which is a 177.8% markup on the unit sold.

(5000 – 1800) / 1800 = 1.7778% or 177.78%

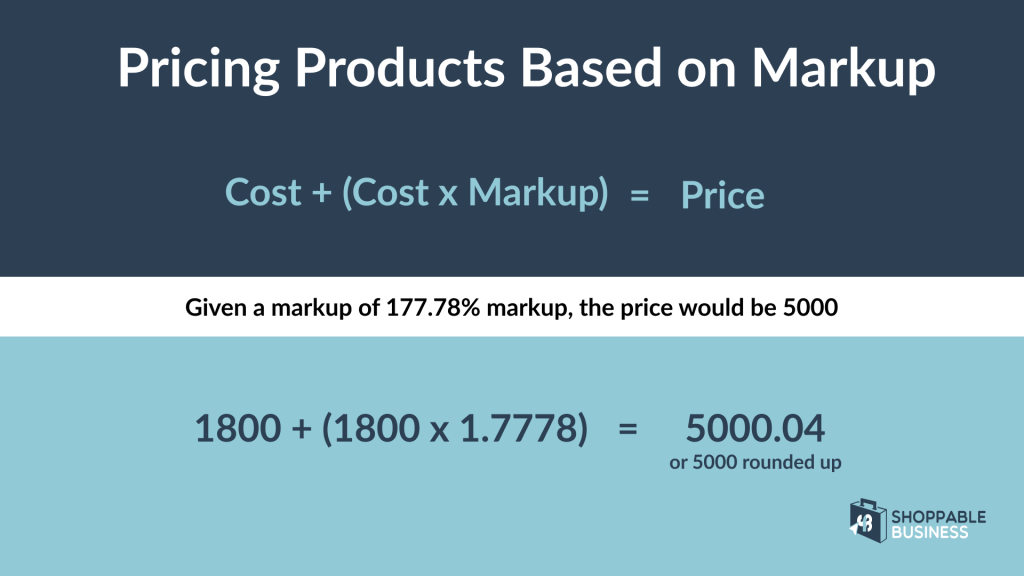

Pricing Products Based on Markup

In other cases, businesses may prefer setting a specific percentage on markup, rather than a fixed value. For example, your business is fully aware of the product cost which is P1,800, and you decided to set a markup of 177.78% on the product. To get the price, here is the formula on pricing products based on markup.

The Difference Between Profit Margin and Profit Margin

While the two terms are essential determinants of profitability, there are some differences between them.

- Basis of Calculation

Profit Margin is the percentage calculated based on total revenue and represents overall profitability. On the other hand, Profit Markup is a specific amount added to the cost of individual products to determine their selling price.

- Purpose

Profit margin provides insight into the overall profitability of a company or a product. It indicates how efficiently a company is at managing its costs and generating profits in relation to its total revenue. It is a key metric for assessing the overall profitability of a business.

While Profit markup is primarily used in pricing strategies. It helps determine the selling price of a product or service by adding a specific amount or percentage to the cost price to ensure that the business can cover its costs and generate a desired profit.

- Profit representation

Profit margin is represented as a percentage, which allows you to see the overall profit percentage you made for a product or company. Higher profit margins are generally preferred.

Profit markup is typically represented as a fixed amount or a percentage increase over the cost price. It is not expressed as a percentage of total revenue, but rather represented as a fixed value profit made for a single unit sold.

Note:

Profit margin = overall profit made, represented in percentage.

Profit markup = profit made for a single unit sold, at a fixed value.

- Strategic flexibility usage

Profit Margin is relatively fixed for a given level of revenue and expenses. It insights the overall profitability of the business.

Profit Markup can be adjusted more flexibly based on pricing strategy and market conditions. Businesses can change the markup percentage or amount to remain competitive or meet specific profit targets.

So, which pricing strategy should your business implement?

One of the advantages of these pricing strategies is that they are both flexible. Your business can opt to both strategies or solely focus on a profit margin-oriented strategy or profit markup-oriented strategy. So when should you apply either both or each strategy?

When you’re starting up, profit markup strategy is a good idea, well because you’re just starting out. This phase of the business is where you are conscious about costs of your business. This allows you to have a learning phase of how much revenue you can bring in.

When the time comes that you have a better grasp of your business revenue, margin can help how much profit you actually make.

It is also important to consider that it is conditional and it really depends on your business financial situation and market changes.

In this part, we will talk about why and when you should use profit margin or profit markup-oriented strategy.

Profit Margin-Oriented Pricing Strategy

- Focus on Overall Profitability

Implementing profit margin means you prioritize the overall profitability of your business. You aim to ensure that, after covering all expenses, you have a healthy percentage of profit remaining from your total revenue.

- Long-Term Sustainability

Profit margin-oriented pricing can help ensure the long-term sustainability of your business by maintaining healthy profit levels that allow for reinvestment, growth, and financial stability.

- Price Flexibility

This approach may provide more flexibility in adjusting prices because you’re concerned with the profitability of your entire product/service line rather than a specific markup for each item.

- Brand Reputation

A focus on profit margin can sometimes align with a premium pricing strategy. This may enhance your brand’s reputation for offering quality and exclusive products to your customers.

Profit Markup-Oriented Pricing

- Micro control on individual products

Implementing profit markup allows micro control over the pricing of individual products or services that you offer. You can set specific markup percentages of amounts for each item based on factors like production costs, perceived value, demand, allowing you to get competitive pricing.

- Competitive Pricing

This approach can be beneficial in highly competitive markets where you need to match or beat competitors’ prices to attract more customers.

- Product-Specific Strategies

Some products or services may have unique cost structures or market dynamics that make profit markup a more suitable approach. For instance, a loss leader strategy might involve pricing certain items with low or negative markup to attract customers while making up profits on complementary products.

- Short-Term Goals

A profit markup-oriented strategy can be useful when you have to meet short-term financial goals. This allows you to quickly adjust pricing to meet those objectives.

Both Profit Margin and Markup Pricing

- Product Diversification

If your business offers a range of products or services with different cost structures, profit margins, and competitive landscapes, it makes sense to apply each pricing strategy where it fits best. For example, you might prioritize profit margin for high-end, unique products while using profit markup for more commoditized items.

- Market Segmentation

Segmenting your customer base can allow you to tailor pricing strategies to different customer groups. You may use profit margin for premium customers who prioritize quality and are willing to pay a premium, while employing profit markup for cost-conscious customers.

- Seasonal or Promotional Sales

During seasonal sales or promotional periods, such as the holidays or Christmas, you might use profit markup to offer discounts on specific items to attract more customers. Meanwhile, maintaining profit margins on other products can help offset potential revenue losses.

- Customer Lifetime Value

Considering the lifetime value of your customers can influence your pricing strategy. You might be willing to accept lower profit margins on initial sales to acquire customers, knowing that you can generate higher profits over the long term through repeat business.

Conclusion

Both profit margin and profit markup are distinct but complementary pricing strategies that play important roles in a business’s financial management and pricing decisions. Understanding the differences and when to apply each strategy is essential for achieving a balanced approach to profitability and competitiveness.

In practice, a successful pricing strategy is often dictated by when to use it and how to use it. Smart businesses tailor their pricing strategies of their products, services, market conditions, and customer preferences. Continuously assessing the market ensures that you opt and implement the right strategy at the right time. This enables you to strike between the balance of profitability and competitiveness.