When it’s time to pass along property to your family, there’s more to think about than simply deciding who gets what. The financial side of things also comes into play, and one important aspect to wrap your head around is estate tax. These taxes might sound a bit complex, but they can have a significant impact on how much property you can leave behind for your beneficiary. In this article we will talk about the significance of estate tax, how it affects property inheritance, and more. Without further ado, let’s jump right into it.

What is Estate Tax in the Philippines

According to the Bureau of Internal Revenue (BIR): “Estate Tax is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition. It is not a tax on property. It is a tax imposed on the privilege of transmitting property upon the death of the owner. The Estate Tax is based on the laws in force at the time of death notwithstanding the postponement of the actual possession or enjoyment of the estate by the beneficiary.”

In simpler and shorter terms, estate tax are tax imposed when transferring property to the beneficiary upon the death of the property owner.

Who pays the Estate Tax in the Philippines

Estate tax us typically shouldered and managed by the executor, administrator, or heirs of the estate. In essence, it’s their responsibility to handle the process of both payment and filing for the estate tax return. This financial obligation arises from the assets and properties left behind by the deceased individual, and those who stand to inherit or manage these assets are the ones entrusted with ensuring that the appropriate estate tax are calculated, paid, and reported according to legal requirements.

How to Compute Estate Tax in the Philippines

When inheriting a property, there are certain deductions imposed by law. These deductions are usually from taxes and other factors such as unpaid debts. Before calculating estate tax, it’s important to talk about common deductions implied, and the importance of understanding gross and net estate.

Gross Estate

The term “Gross Estate” refers to the total value of an individual’s net worth, assets, properties, before the common deductions such as taxes and liabilities are implemented. This includes a wide range of assets such as real estate properties, bank accounts, investments, personal belongings, and other forms of wealth.

In the Philippines, assets such as SSS accruals, GSIS benefits, life insurances, and retirement benefits are excluded from Gross Estate.

Net Estate

On the other hand, Net Estate refers to the value of the properties right after the common deductions are subtracted from the Gross Estate. Frequently applied reductions involve standard deductions valued at ₱5 million; obligations tied to the estate, such as debts and unpaid mortgages, taxes, and losses from accidents; as well as the family home, assessed based on its present fair market value.

Computation for Estate Tax in the Philippines

What is the computation for Estate Tax in the Philippines? It’s 6% of the total net estate. Once all common deductions are subtracted from the Gross Estate, multiply the value by 0.06 (which represents 6%) and you will get the computation for how much you will pay and file for the estate tax.

What are the Requirements for Filing and Paying Estate Tax in the Philippines 2023

Properties and assets are of great import when passing it down to a beneficiary, and it takes a lot of requirements, documents, and identification. Here are the mandatory requirements for filing and paying estate tax in the Philippines.

Mandatory Requirements (According to BIR):

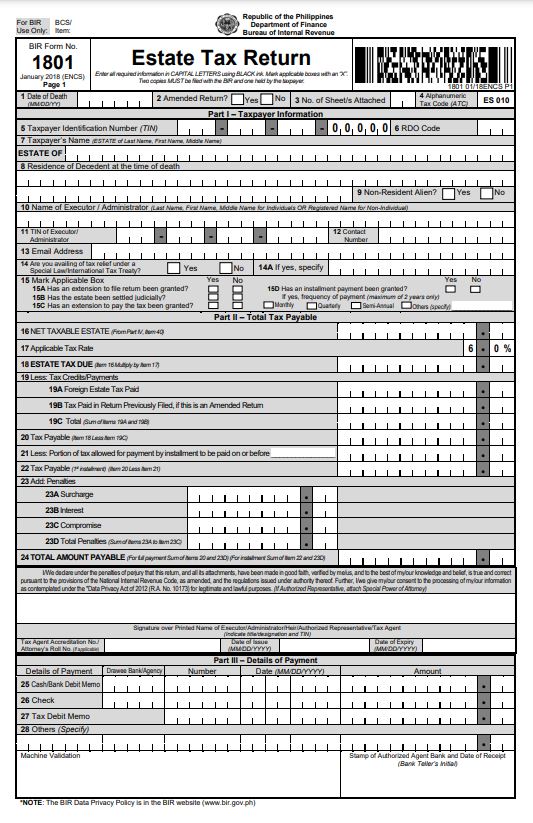

- Estate Tax Return Form (BIR Form 1801)

- Certified true copy of the Death Certificate; (One (1) original copy and two (2) photocopies)

- TIN of decedent and heir/s; One (1) original copy for presentation only)

- Any of the following: (One (1) original copy and two (2) photocopies)

a) Affidavit of Self Adjudication;

b) Deed of Extra-Judicial Settlement of the Estate, if the estate has been settled extra

judicially;

c) Court order if settled judicially;

d) Sworn Declaration of all properties of the Estate;

- A certified copy of the schedule of partition and the order of the court approving the same within thirty (30) days after the promulgation of such order, in case of judicial settlement. (One (1) original copy and two (2) photocopies)

- Proof of Claimed Tax Credit, if applicable; (One (1) original copy and two (2) photocopies)

- CPA Statement on the itemized assets of the decedent

- Certification of the Barangay Captain for the claimed Family Home (If the family home is conjugal property and does not exceed Php10 Million, the allowable deduction is one-half (1/2) of the amount only); (One (1) original copy and two (2) photocopies)

- Duly notarized Promissory Note for “Claims Against the Estate” arising from Contract of Loan; (One (1) original copy and two (2) photocopies)

- Accounting of the proceeds of loan contracted within three (3) years prior to death of the decedent; (One (1) original copy and two (2) photocopies)

- Proof of the claimed “Property Previously Taxed”; (One (1) original copy and two (2) photocopies)

- Proof of the claimed “Transfer for Public Use”; (One (1) original copy and two (2) photocopies)

- Copy of Tax Debit Memo used as payment, if applicable. (One (1) original copy and two (2) photocopies)

Note: The Bureau of Internal Revenue (BIR) may require additional and applicable documents, depending on the property and value being handed over to the beneficiary. You may contact BIR’s estate division at 8538-3200, or contact them via email at [email protected] if you have any questions and clarifications regarding the filing of Estate Tax.

How to file Estate Tax Returns in the Philippines

The due date on filing and payment of the return/tax will depend on the applicable law at the time of the decedent’s death.

The Estate Tax Return (BIR Form 1801) needs to be submitted within one year after the person passes away by the executor. The BIR commissioner can grant an extension period up to 30 days.

The return shall be filed with any Authorized Agent Bank (AAB) of the Revenue District Office (RDO) having jurisdiction over the place of domicile of the decedent at the time of his death. If the decedent has no legal residence in the Philippines, the return shall be filed with the Office of the Commissioner (RDO No. 39, South Quezon City).

Conclusion

Behind the benefits of acquiring assets, properties, or titles, it is also important to learn and be knowledgeable in the process of acquiring inheritance. Learning things such as net estate, tax deductions, common deductions, can make it easier for you to process and file Estate Tax in the Philippines.