The average headline inflation in the Philippines for 2022 reached 5.8 percent, higher than the 3.9 percent posted in 2021 and well above the target range of 2.0 to 4.0 percent. Source – Senate Economic Planning Office

Inflation in the Philippines disrupts the economical scale of individuals and businesses. More importantly, inflation heavily affects the middle to lower class, especially in the Philippines. The persistent inflation is a familiar challenge With less purchasing power and zero wage adjustments to match the continued rising prices of commodities, goods, and production costs, inflation can shift consumer spending behaviors, affecting corporations, businesses, and the whole economic cycle of the country. Inflation isn’t something that individuals or businesses can control. Nevertheless, we can adapt to the uncertainty of inflation. In this article, we will focus on how businesses can strategically place themselves in the market with the surging inflation in the Philippines without compromising the quality of products and services you provide. But first, let’s explore the many ways how inflation can affect consumers and businesses

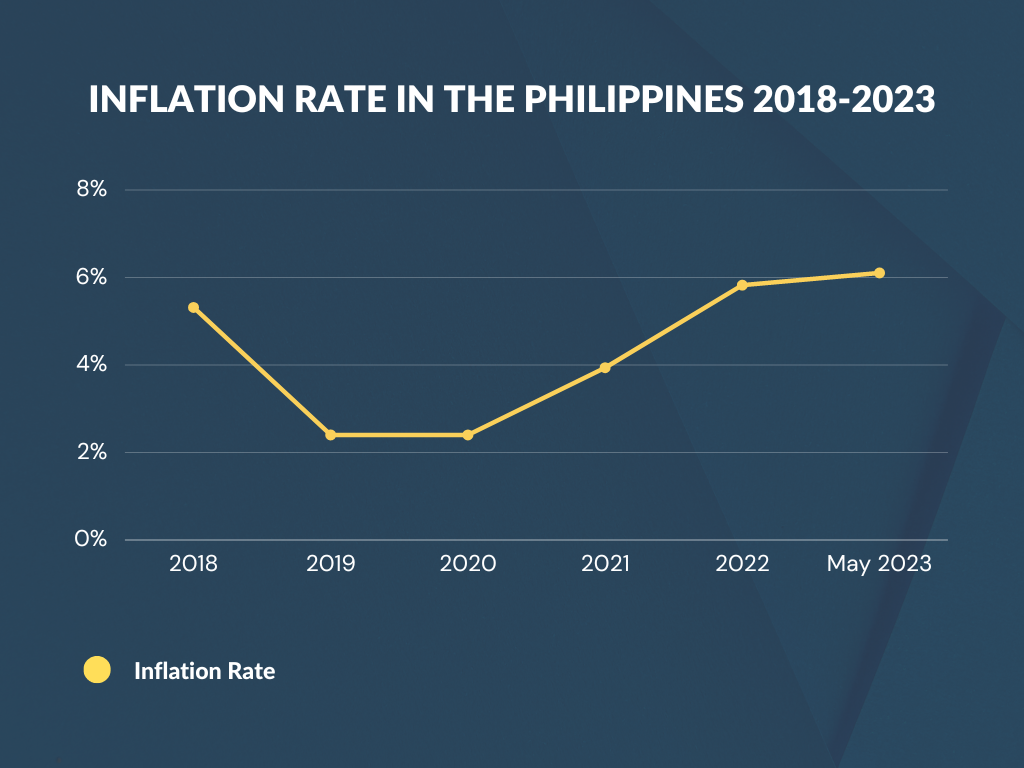

Inflation Rate in the Philippines from 2018-2023

Philippines inflation rate as of May 2023 is 6.1%, a 0.28% increase from 2022.

Philippines inflation rate for 2022 was 5.82%. a 1.89 increase from 2021

Philippines inflation rate for 2021 was 3.93%, a 1.54% increase from 2020.

Philippines inflation rate for 2020 was 2.39%, a 0% increase from 2019.

Philippines inflation rate for 2019 was 2.39%, a 2.92% decline from 2018.

Philippines inflation rate for 2018 was 5.31%

The Effect of Inflation towards individuals and businesses in the Philippines

Decreased purchasing power

When inflation occurs, the cost of goods and services rises, resulting in a decrease in the purchasing power of individuals. This happens due to the depreciation of the currency, or the Philippines Peso in the Philippines. This means that individuals and businesses may find it more challenging to afford the same quantity of goods or maintain the same standard of living. It can impact consumer spending patterns, leading to a decline in demand for non-essential goods and services.

Financial pressures on individuals

Inflation can place financial pressures on individuals, particularly those with fixed incomes or minimal savings. It becomes harder for individuals to keep up with rising prices, leading to a decline in their standard of living. This can have a cascading effect on businesses, as reduced consumer spending can affect sales, profit, and revenue.

Higher production costs

Inflation often leads to increased production costs for businesses. This can be due to rising prices of raw materials, energy, and labor. As businesses face higher operating expenses, it becomes more difficult to maintain profitability without passing on these increased costs to customers. Small and medium-sized enterprises (SMEs) may be particularly vulnerable, as they may have limited pricing power and struggle to absorb cost increases.

Volatility in business forecasting

Inflation creates uncertainty in business planning and forecasting. Businesses may find it challenging to accurately predict costs, revenues, and profitability when goods and production costs are volatile. This uncertainty can make it difficult to make articulated decisions about investments, expansion plans, and hiring, impacting long-term growth strategies.

Impact on investment and borrowing

In an inflationary environment, borrowing costs may rise as interest rates increase as compensation by lenders for the decreasing purchasing power. This can make it more expensive for businesses to access credit, limiting their ability to invest in growth initiatives or fund capital expenditures. Higher borrowing costs can also discourage individuals from taking on loans, affecting consumer spending and investment activities.

To navigate through this economic chaos, businesses should reconsider strategies such as efficient cost management, strategic spending habits, and a focus on customer loyalty that won’t place your business in a loss.

5 Strategies to Make Your Business Thrive Under the Inflation

Rather than spiking your prices under an economic crisis or compromising the quality of your products and services, here are ways your business can adapt during an inflation.

- Reduce profit margin

Reducing your profit margins is one of the easiest ways to adapt to the rising prices due to inflation. This enables your business to maintain the quality of products and services it provides, while maintaining customer loyalty. In the short term, it may result in lower profits, or worse case scenario, play on a loss. But in the long run, you will maintain a healthy flow of loyal customers to your store.

- Strategic pricing model

Planning a strategic pricing model enables your business to entice customers to avail your products and services in an inflationary environment. Filipinos love to haggle, purchase items on sale or when they can get a deal on a product at a much cheaper price. An example of implementing a strategic pricing model is the rising popularity of the mix-and-match options for restaurants such as Jollibee, McDonalds, KFC, and many more. This entirely depends on the type of products or services that your business offers, but most of the time, this type of strategy is flexible to all types of businesses.

- Enforce positive supplier relationships

Nurturing a positive relationship with your suppliers is underemphasized when reducing costs for your business, especially during an inflation in the Philippines. Inflation can significantly impact the cost of raw materials and supplies, making it essential to enforce positive relationships with suppliers. By nurturing these relationships, businesses can effectively manage costs and negotiate favorable terms even in an inflationary environment. When suppliers perceive a strong partnership and mutual trust, they are more likely to work collaboratively to find cost-saving solutions, offer competitive pricing, and provide discounts or incentives.

Looking for a consistent supplier to provide stocks and raw materials for your business is challenging. Having multiple suppliers with no assurance that you’ll receive products up to your standards can compromise your products and services. If you’re looking for a supplier with the capabilities to ensure products are of high quality, delivered on time, and consistently around when you need them. A specific eCommerce platform in the Philippines, Shoppable Business, can connect you with vetted suppliers ensuring all products are 100% authentic.

- Utilize technology to reduce costs

Automating your business is another way to reduce costs for your business. By automating repetitive and time-consuming tasks, businesses can significantly reduce labor costs. Technology enables businesses to automate processes such as production, inventory management, and administrative tasks, which not only saves time but also minimizes the impact of rising labor expenses.

One way to automate your business digitally is to join an eCommerce platform. Ecommerce platforms can take care of your inventory management, order fulfillment, packaging, deliveries, and shipment, while you solely focus on selling and handling your business. Joining an eCommerce platform like Shoppable Business can take off the weight of finances and workload of your shoulder, allowing you to nurture your business in operations that matters most.

- Utilize business financing

Utilizing business financing is a powerful move to stay afloat in the rising prices during an inflation in the Philippines. Although it may involve some risks, you need to play your cards right when planning for a business loan. Applying for business financing can help you procure necessary equipment, stocks, and manpower, to help push your business through an inflationary period. Utilizing business financing the right way can help you rise above the competition, garnering more customers and sales.

Applying for business financing during an inflationary period can be a rewarding strategy, yet a risky one, but it doesn’t have to be that way. If you’re looking for business financing solutions, Shoppable Business can provide business financing solutions without the worries of growing interests. With Shoppable Business, BNPL (buy now, pay later), your business can get products, stocks, and inventory without upfront payments at 0% interest rates.

Shoppable Business is a B2B eCommerce platform in the Philippines, championing of digitizing business in the Philippines. Shoppable Business also aims to make traditional procurement stress free by digitizing and automating the procurement process for businesses. The eCommerce platform offers a wide array of business solutions for businesses in the Philippines such as BNPL financing solutions, vetted suppliers in the platform, digitizing business compliance through issued invoices and BIR form 2307 with a click, and wholesaling for businesses that need equipment, stocks, and inventory.

Why Become a Seller in Shoppable Business

- Access to a large customer base – giving businesses an opportunity to expand their reach and increase sales

- Increased visibility and brand awareness – a platform for businesses to showcase their products/services and potentially attract new customers

- BNPL (Buy now, Pay later) – grow your ASP; buyers/companies can apply for loans up to ₱150,000.00

Why Become a Buyer in Shoppable Business

- Wide product selection from different categories – a one-stop-shop solution for businesses’ procurement needs

- Save company time and money – Customized orders, RFQ for specific quantities, bundles, configuration, Track their orders, view purchase history

- Need it now but limited budget – Buy Now Pay Later – apply and get up to ₱150,000.00

- 100% Authentic products only every time you buy.

Sign up as a buyer or as a seller to join Shoppable Business and do your business a favor to adapt to the rising prices of inflation by digitizing your business.